Fiscaliteiten

-

In welke bijtellingscategorie valt mijn auto?

Wanneer je met een auto van de zaak ook privéritten (meer dan 500 km per jaar) maakt, dan krijg je te maken met een bijtelling. Deze bijtelling bestaat uit een bepaald percentage van de fiscale waarde van de auto dat bij jouw brutoloon wordt opgeteld. Dit percentage is afhankelijk van de CO2-uitstoot van de auto.

CO2-uitstoot Bijtelling 0 g/km 16% Meer dan 0 g/km 22% De meeste auto’s vallen dus in het bijtellingspercentage van 22%. Voor volledig elektrische auto's geldt een bijtellingspercentage van 16%. Deze 16% bijtelling geldt alleen tot een bedrag van €30.000. Is jouw leaseauto duurder, dan geldt over het restbedrag een bijtelling van 22%.

Voor youngtimers geldt een ander percentage. Wanneer jouw auto ouder is dan 15 jaar, spreken we van een youngtimer. Voor deze auto's geldt een bijtelling van 35% over de dagwaarde van de auto.

Vragen?

E-mail: info@directlease.nl

Telefoon: 0541 - 571 710 -

Waarom betaal ik bijtelling?

Mag je een auto van de zaak leasen? Houd er dan rekening mee dat je te maken kunt krijgen met een netto ofwel fiscale bijtelling. Als leaserijder betaal je deze bijtelling alleen als je jaarlijks meer dan 500 kilometer privé rijdt.

Netto of fiscale bijtelling: Een geldbedrag dat je betaalt wanneer je jouw zakelijke leaseauto gebruikt voor privéritten.

Hoe zit dit? Wil je met jouw leaseauto privéritten maken, dan ziet de Belastingdienst dit als het ware als loon in natura. Vandaar dat ze hebben bepaald dat je hier belasting over moet betalen.

Deze bijtelling wordt – als je in loondienst bent - als bijtelling op jouw loonstrook vermeld. Je betaalt belasting over het totale bedrag van salaris en bijtelling.

Rekenvoorbeeld:

Stel, je hebt een auto met een fiscale waarde van €30.000 en een bijtellingspercentage van 22%. Jouw bijtelling is dan €6.600 per kalenderjaar. Gedeeld door twaalf maanden bedraagt de bruto bijtelling dan €550 per maand. Voor de berekening van de netto bijtelling wordt dit bedrag vermenigvuldigd met het tarief inkomstenbelasting. Bij een bruto jaarsalaris tot €68.508 is dit 37,35 %. De netto bijtelling wordt in dit voorbeeld 37,35 % van €550, dus € 205 per maand.Vragen?

E-mail: info@directlease.nl

Telefoon: 0541 - 571 710 -

Hebben de opties die ik kies invloed op de bijtelling die ik betaal?

Bijtelling wordt berekend over de cataloguswaarde, inclusief opties af fabriek. Alles wat door derden (importeur, dealer, etcetera) wordt in- of opgebouwd telt niet mee.

Vragen?

E-mail: info@directlease.nl

Telefoon: 0541 - 571 710 -

Hoe wordt mijn netto bijtelling berekend?

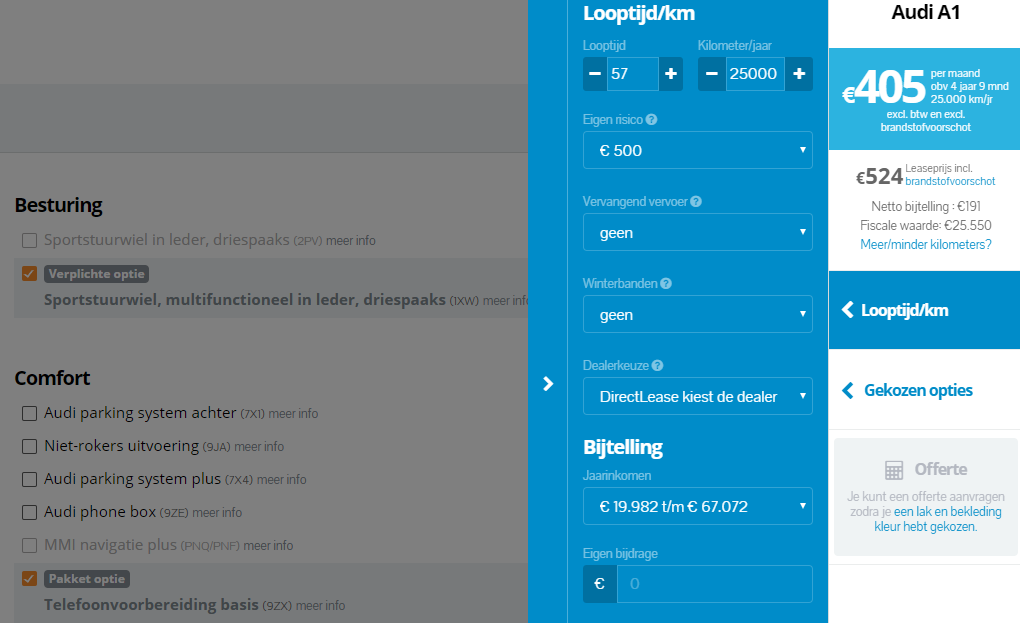

Bij ons hoef je niet zelf met een rekenmachine de bijtelling te bereken. Op onze site kun je namelijk direct zien wat de netto bijtelling gaat zijn.

Stap 1:

Klik op de auto die je wilt calculeren en start het proces: kies de kleur, pakketten en opties. Je ziet dan aan de rechterkant van de pagina onze maandlasten tabel. Welke opties je ook kiest: het leasebedrag, de fiscale waarde en de netto bijtelling worden automatisch berekend en afgebeeld.Stap 2:

Klik je op looptijd? Dan klapt de tabel uit (zie afbeelding hieronder).

Door hier jouw jaarinkomen en eventuele eigen bijdrage in te vullen, wordt de netto bijtelling nauwkeuriger.Let op: bij de berekening wordt er geen rekening gehouden met de inkomensafhankelijke algemene heffingskorting en arbeidskorting. Hierdoor kan jouw bijtelling uiteindelijk hoger uitvallen.

Vragen?

E-mail: info@directlease.nl

Telefoon: 0541 - 571 710

-

Wordt bij een tweedehands auto de bijtelling over de huidige- of cataloguswaarde gerekend?

De fiscale bijtelling wordt geheven over de cataloguswaarde van de auto. De tweedehands waarde is dus geen grondslag.

Vragen?

E-mail: info@directlease.nl

Telefoon: 0541 - 571 710 -

Gaat de fiscale bijtelling over de catalogus waarde inclusief of exclusief BPM?

De fiscale bijtelling wordt berekend over de cataloguswaarde inclusief BPM en BTW.

Vragen?

E-mail: info@directlease.nl

Telefoon: 0541 - 571 710